Brazil has become one of the top countries for cardiac pacemaker usage and manufacturing in South America. With a growing population experiencing higher rates of heart disease, the need for pacemakers has increased tremendously in recent decades. This article provides an overview of the cardiac pacemaker industry and usage in Brazil.

Growth of the Cardiac Device Industry in Brazil

The cardiac device industry in Brazil has experienced significant growth over the past 20 years. Initially, Brazil imported all of its pacemakers from companies in the United States, Europe, and Asia. However, in the 1990s, Brazilian companies started manufacturing their own pacemakers to meet the rising domestic demand. Some of the largest Brazilian cardiac device companies today include Flexa, Medtronic Brazil, and Biotronik Brazil. These companies produce a wide range of implantable cardiac devices including pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy devices (CRT).

Flexa, one of the first Brazilian companies to manufacture pacemakers locally, has grown to become a leader in the domestic market. In 2000, Flexa produced around 15,000 pacemakers annually. Today, its annual production has increased over 5-fold to more than 80,000 units. Similarly, Medtronic Brazil now produces over 60,000 implants each year at its three manufacturing plants located in Brazil. The success of these companies has not only met the needs of Brazilian patients but has also allowed the country to become a pacemaker exporter, shipping devices to other Latin American and African countries.

Rising Prevalence of Heart Disease

A key driver for the Brazil Cardiac Pacemakers has been the rising rates of cardiovascular disease. Like many developing nations experiencing economic growth and dietary changes, rates of obesity, diabetes, hypertension, and other heart disease risk factors have increased dramatically in Brazil over the past few decades. According to the World Health Organization, cardiovascular disease is the number one cause of death in Brazil, accounting for over 300,000 deaths annually.

The higher occurrence of heart disease has resulted in greater need for cardiac device implantation. Between 2000 and 2010 alone, the pacemaker implantation rate in Brazil more than doubled from around 30,000 to over 75,000 procedures per year. Experts project that if current trends continue, the annual pacemaker implantation volume could surpass 100,000 within the next 5 years. The aging population and increasing life expectancy will further elevate heart disease burden and cardiac device demand going forward.

Pacemaker Usage by Region

The usage of pacemakers varies considerably between different regions in Brazil largely depending on access to healthcare resources. The southern states of Brazil with higher average incomes and more advanced medical infrastructure have the highest pacemaker implantation rates. For example, the states of Rio Grande do Sul and Santa Catarina perform over 10,000 pacemaker procedures annually between their populations.

In contrast, states located in northern Brazil that include poorer and more rural areas have faced greater challenges in delivering adequate cardiac care. Pacemaker implantation rates in states like Para, Rondonia and Acre can be as low as 200-500 procedures per year despite having populations of over 3 million people each. Federal and state government health programs have tried to expand device access in underserved regions. Mobile pacemaker clinics have also helped improve implantation capacity, especially in remote Amazon areas. Overall nationwide pacemaker usage is high along Brazil’s urban coastlines but more heterogeneous in the interior states.

Pacemaker Technology Advancement

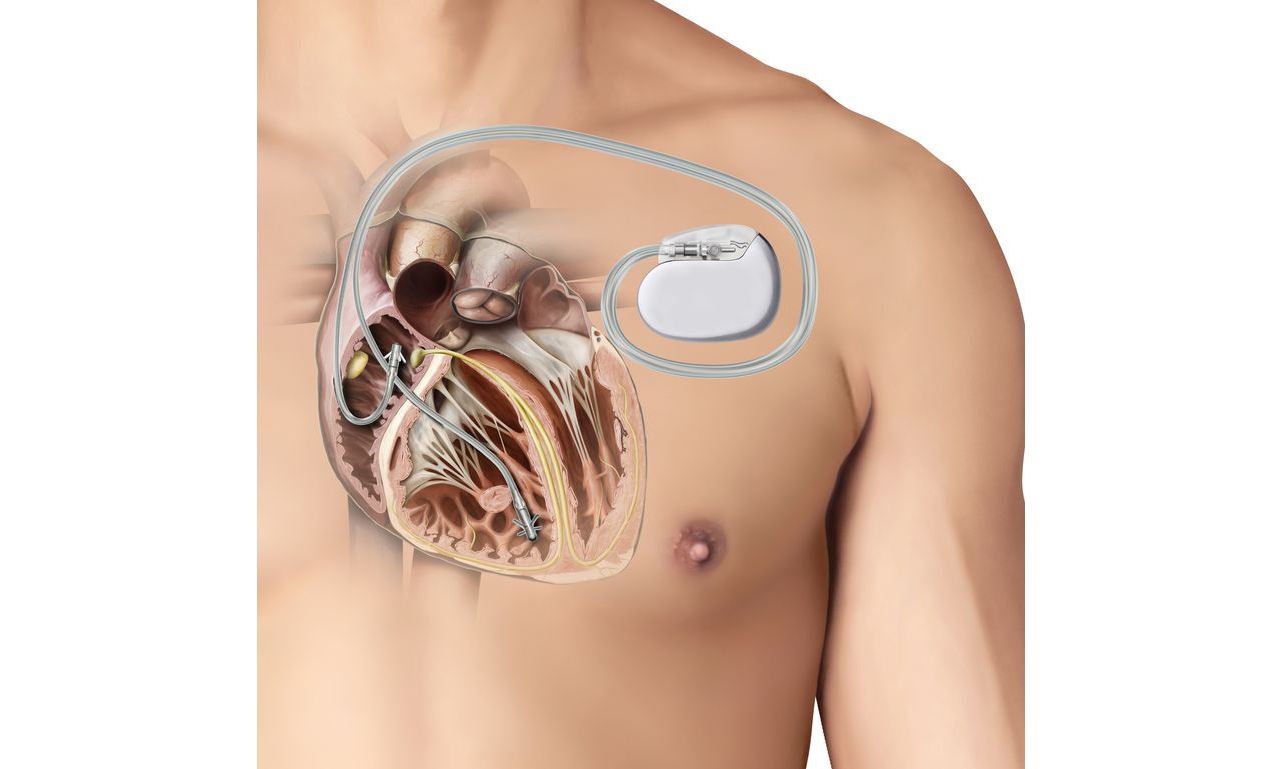

In line with global trends, pacemaker technology in Brazil has advanced significantly since the first domestic devices were introduced. Early Brazilian pacemakers provided basic function but limited programmability. Modern implants now offer sophisticated features like rate-responsive pacing, cardiac resynchronization, remote monitoring via Bluetooth or cellular connections, and enhanced longevity with battery lives exceeding 10 years.

Most Brazilian patients receive dual-chamber pacemakers which coordinate both upper and lower heart chamber pacing for improved hemodynamics over single-chamber models. Biotronik Brazil has had success with its responsive pacemakers able adjust pacing rates based on patient activity levels and symptoms using proprietary algorithms. Meanwhile, Medtronic Brazil markets advanced CRT devices that coordinate contractions between the two lower heart chambers to optimize cardiac pumping in heart failure patients.

These technology innovations have allowed Brazilian pacemakers to provide more physiologic support tailored to individual patient needs. Remote monitoring capabilities have also enabled cardiac specialists to oversee device function and monitor for arrhythmias without requiring in-person clinic visits. Combined with improving surgical techniques, modern Brazilian pacemakers are helping more patients achieve relief from symptomatic bradycardia and improve quality of life.

Future Outlook

Looking ahead, the Brazilian pacemaker market is projected to continue growing steadily to keep pace with sociodemographic changes driving higher rates of heart disease diagnosis. Expanding access to healthcare in underserved regions will boost implantation rates in the country’s northern and midwestern states. Technological advancements in leadless pacemakers may gain more traction as alternatives to traditional transvenous devices. Overall, Brazil’s strong cardiac device manufacturing industry will ensure patients have access to high-quality made-in-Brazil pacemakers well into the future. With a stable regulatory environment and supportive government policies, the cardiac device sector will remain a bright spot in Brazil’s healthcare landscape.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it.