Market Size and Growth Trends

Over the past decade, the has shown impressive growth expanding at a CAGR of over 15%. The market was valued at approximately Rs 2500 crore in 2020 and is projected to reach Rs 5000 crore by 2025 driven by the exceptional annual growth rate of over 17%. The increasing burden of CVDs, growing elderly population, wider insurance coverage and availability of indigenously manufactured stents at affordable costs are some of the key factors fueling the growth of this market. Progressive lifestyle changes, rising disposable incomes and growing medical tourism are also contributing to the market expansion in India.

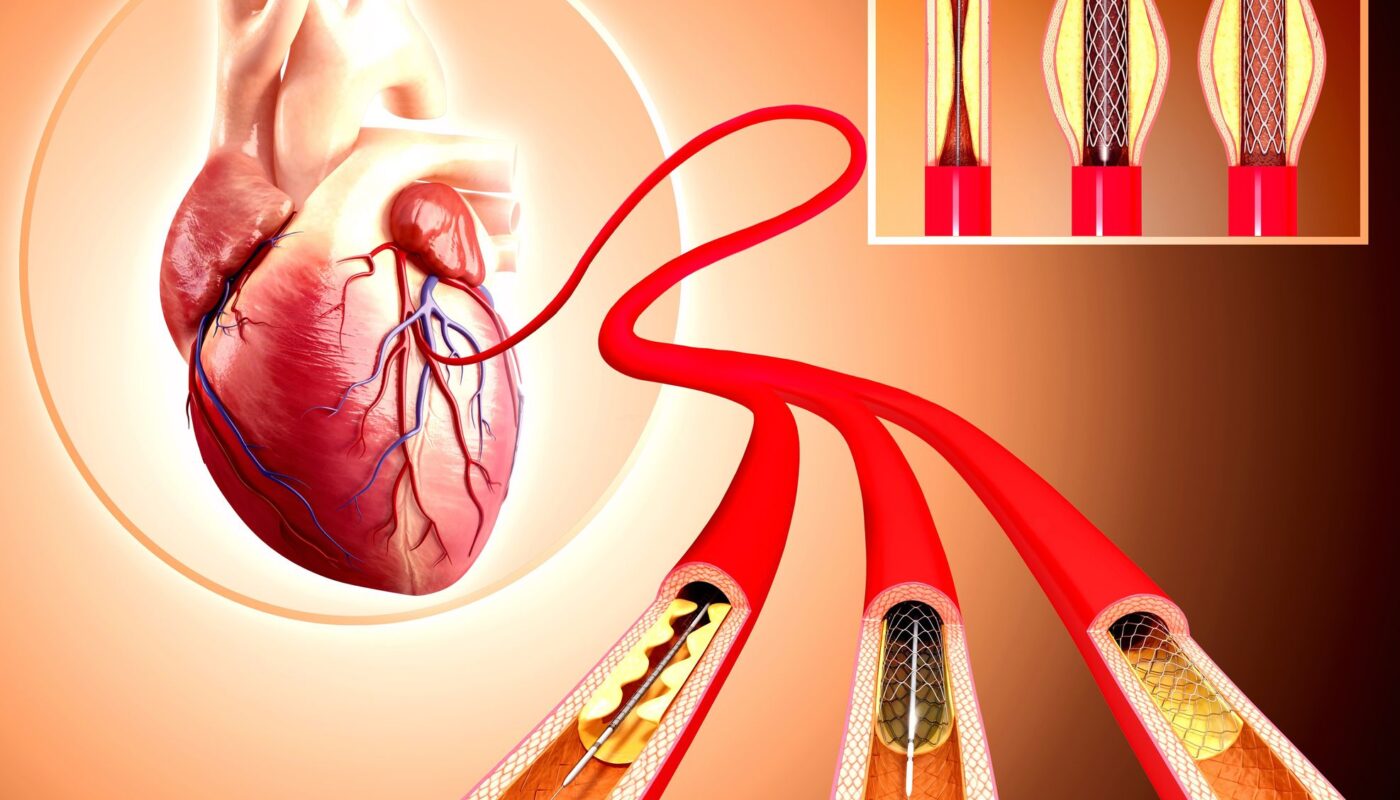

Product Type Insights

Metal stents dominated the Indian market capturing over 90% share compared to bioresorbable vascular scaffolds (BVSc) and drug eluting stents(DES). Recent data suggests a gradual shift towards the adoption of DES and BVSc due to their potential advantages over bare metal stents with respect to restenosis rates. DES continue to expand their market share with continuous innovations to enhance efficacy, safety and cost effectiveness. BVS designed to dissolve completely within 3 years after placement are also gaining traction albeit at a gradual pace due to their higher costs.

Usage in Hospitals vs Cath Labs

Major interventions are performed across large tertiary care hospitals representing 70% of total stent usage in the country. A significant proportion nearly 30% is also utilized in standalone cardiac catheterization labs (Cath labs) especially in tier II and tier III cities. These Cath labs play a pivotal role in facilitating timely access to angioplasty services closer to patients homes in smaller towns and semi-urban areas. Their contribution to catering the overall demand is projected to witness robust growth over the coming years supported by expanding infrastructure and healthcare penetration in rural pockets.

Regional Demand Analysis

Indian Coronary Stents Metropolitian cities including Delhi NCR, Mumbai, Bengaluru, Chennai, Pune and Kolkata account for over 60% of total coronary stent demand. Southern and western states collectively amount to approximately 50% share while northern and eastern regions make up the remaining demand. Rapid urbanization, growing healthcare facilities and higher affordability in these areas drives their dominant market position currently. However, northeastern states reflecting poorer socioeconomic conditions and inadequate infrastructure development continue to lag behind. Efforts to fortify primary care in these lagging regions will balanced regional access over the long term.

Domestic Manufacturing Trends

Indian coronary stent industry has achieved self-sufficiency with domestic manufacturing representing nearly 90% market share as of 2020. Major homegrown stent manufacturers such as Sahajanand Medical Technologies, Terumo Cardiovascular, and Biotronik capturing over half the market. Foreign companies including Abbott Vascular, Boston Scientific, Medtronic and B Braun also have a significant presence in the Indian market. The government’s active support for medical device parks and streamlined regulations has promoted localized manufacturing. Local production enables stable supplies at affordable costs. Overall domestic manufacturing capacity is expected to further expand to cater rising demand.

Stent Prices and Pricing Pressures

Prices of coronary stents in the Indian market have shown a declining trend over the past 5 years with average costs declining by 40-50% . Bare metal stents costs range from Rs 8000-15000 while DES prices range between Rs 15,000 to 25,000 depending on brands and specifications. Government initiatives including capping of prices through National Pharmaceutical Pricing Authority (NPPA) and inclusion of cardiac stents under health insurance plans have made the life saving procedure more affordable for a larger population. However factors such as high GST rates translation to increased MRPs and frequent price revisions exert some upward pricing pressures. Regulated pricing will ensure continued access.

Role of Health Insurance

Health insurance has emerged as a critical enabler in expanding access to coronary stents in India. Public sector insurance programs have played a pioneering role in covering the high costs with over 30 crore beneficiaries under flagship schemes like Ayushman Bharat and Employees State Insurance Corporation. Privately held insurance providers are also expanding their coverage with many comprehensive plans including angioplasty and stenting procedures. As per industry estimates, over 30% of total stent implantations in India are covered under medical insurance currently. Wider risk pooling across the population will help reduce financial barriers and ensure Universal Health Coverage.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it